Edição 78 Março/Abril| Download.

Customer Service, Safety and Digitization – FNB Mozambique committed to excellence

Banking services in Mozambique have been in constant evolution, following the dynamics of the market itself. First National Bank Moçambique – FNB, a subsidiary of the FirstRand Group, the largest financial institution in Africa by market capitalization, is one of the banking institutions that has been working to provide safe and consistent high-quality services that are customer-centered.

Advertising

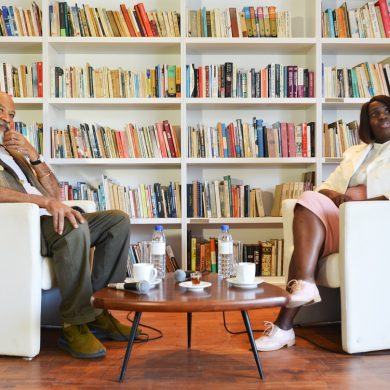

“We want FNB to offer a safe banking experience”.

Defining these key customer-centered objectives was actually one of the turning points for FNB. According to FNB’s Managing Director (CEO), Peter Blenkinsop, the bank’s commitment is to become a reference for banking institutions in the Mozambican market. “We want FNB to offer a safe banking experience,” highlights the CEO, stressing that in order to achieve this ambition “there is work that must be done in a coordinated and structured way.”

With vast experience in banking and having worked in the Nigerian market, Blenkinsop looks at the Mozambican banking sector with optimism and believes in its enormous potential. But in order to fulfill that potential, there must be alignment among all key players. “It is imperative that the authorities, banks and the business sector, together with development funds, work together to release all that potential,” defends FNB’s CEO, explaining that “there are more skills in this market than you think and these must be explored and released to the best of their ability, so that they can flourish and develop.”

Referring to a recent analysis by economists from the FirstRand group, Peter Blenkinsop points out that, of the group’s nine subsidiaries, “Mozambique is the one with the greatest growth potential but it is also the country with the lowest credit rating.”

“Analyzing these factors, I believe that all stakeholders in this sector – government, regulators and the financial sector – must start working towards achieving a better credit rating, celebrating ethical business, good governance with a cooperative judicial system so that we can, finally, manage to make the cost of credit more affordable and make transactions simpler, creating conditions for an environment that is beneficial to all,” he stresses.

Peter suggests a radical change in the private sector, with a view to seizing the many opportunities of the financial sector. “The most relevant aspect to improve, at the level of the private sector, is financial discipline. Banks are, in fact, just a financial intermediary between those who save and those who borrow. Companies that do not adopt financial discipline are ultimately harming the entire financial ecosystem and, especially, individuals who keep their savings in banking institutions.”

Regarding the key sectors with impact on the national economy, Peter Blenkinsop considers that, even though Mozambique is moving towards a phase of exploring its natural gas reserves, it is necessary to adopt a holistic approach and gradually build something solid and consistent, so that the Mozambican economy does not remain solely dependent on megaprojects.

Speaking on digitization, despite FNB’s advances in the digital transformation process, Blenkinsop defends the need to guarantee the robustness of applications made available by banks. “We need to find a way to work together with platforms such as M-pesa, e-Mola and regulators to achieve greater efficiency towards financial inclusion, as mobile wallet operators have a significant advantage over banks, since they don’t deal with cash handling, a rather costly operation.”

“The solution is for the competent authorities to regulate transaction fees for end users, so that neither mobile network operators nor banks are unduly favoured.”

Reflecting on FNB’s core values, Peter highlights the importance of customers and the work already done always bearing in mind their needs, as well as the team’s cohesion, building trust and a commitment to innovation.

Edição 78 Março/Abril| Download.

0 Comments